Why AI Isn’t Ready for Food Systems (Yet)

Before AI can deliver, the food industry needs stronger execution layers and CRM foundations to turn relationships into action.

I attended Gulfood 2026 in Dubai, now the world’s largest food trade show, with 8,500+ exhibitors from 195 countries and more than 1.5 million products on display.

A parallel I can draw from my experience is how it rivals events like Mobile World Congress in Barcelona, which draws around 2,900 exhibitors and claim to bring 100k people. But the similarity ends there. MWC is dominated by listed companies, platforms, and venture-backed tech firms. Gulfood, by contrast, operates at a bigger scale and with a very different industrial gravity.

The Gulfood floor is full of established producers: family businesses, cooperatives, and long-term exporters. Many are private and are deeply dependent on their national export strategies.

Countries and companies that still believe in open, global trade were present in force. Those whose posture is shifting were noticeably less visible; a reflection of how trade assumptions are being re-examined. Also, Dubai’s role in this is fascinating. The city has moved beyond food security and survival logistics to become a global hub for food trade and deal-making.

From an Australian perspective, being a major food exporter, its presence felt modest. Austrade support and even ministerial attendance were positive, but when compared with countries like Thailand (highly coordinated and commercially aggressive) the gap was obvious.

Gulfood makes a simple point: global food trade is reorganising around those who show up well prepared, well coordinated, and committed to openness. Australia has the assets, credibility, and market access. What felt missing was the same level of ambition.

AI buzz

This year, Gulfood was framed as a space where artificial intelligence and digital innovation could meet the global food ecosystem. But there was a big contrast between vision and reality.

The agenda featured AI-focused workshops, including sessions on using AI across supply chains. But on the floor itself, the feel was overwhelmingly analogue. The dominant presence remained producers and exporters: meat, dairy, grains, fresh produce, national pavilions and commoditised products; rather than software companies selling into those who could use the tech to manage compliance, automation, robotics in processing, intelligent packaging or real-time decision-making systems.

One of the most interesting sessions I attended was the Future Food 500 panel “Champions of Change – Leading Transformation Through Digital Platforms.” What stood out from the featured speakers was their innovative focus on execution. The most compelling contributions came from Dan Ghadimi (Bowimi), Sharoon Saleem (Salesflo), and Sidi Ragi (Centric Software).

The tools they promote do not replace ERP, CRM, or data warehouses. They sit alongside them, turning operational data into action for specific roles. Conceptually, this is sophisticated and points to where innovation in the food industry should be happening.

For example, Bowimi is used to equip sales teams with real-time context about what products are stocked, what promotions are live, what feedback was captured, etc. so reps spend less time reporting and more time acting on what they see in-market. The intelligence comes from the field, but it feeds back into central sales and planning systems.

Salesflo addresses secondary-sales and channel visibility that ERPs typically miss. By combining order data and frontline activity into a workflow, sales teams can see how products are actually moving through distributors and outlets, allowing faster adjustments to pricing, promotions, or stock allocation.

Centric Software focus is on the product side. By maintaining a single source of truth for products (i.e. ingredient costs, regulatory constraints, and sustainability attributes) teams can assess changes in formulation, sourcing, or market entry against validated data. When demand emerges, decisions about whether a product can be adapted, approved, or launched are made on current, shared information rather than spreadsheets and email chains.

This "execution layer" is where innovation in food should currently be happening. As Sidi Ragi put it, the constraint is no longer insight, it’s speed. The companies that shorten the loop between market signal and execution, connecting demand directly to product, supply, and compliance through unified workflows rather than fragmented tools , siloed Excel files and emails, will win.

But this layer only works if the fundamentals are already in place.

Execution tools depend on clean product data, reliable transactions, and structured customer and supply information underneath. Without solid ERP, CRM, and data-warehouse foundations, these upper layers have nothing reliable to act on. AI in the food industry can reduce friction by surfacing options, trade-offs, and consequences faster, but only once the basics are right.

Relationships Without a System

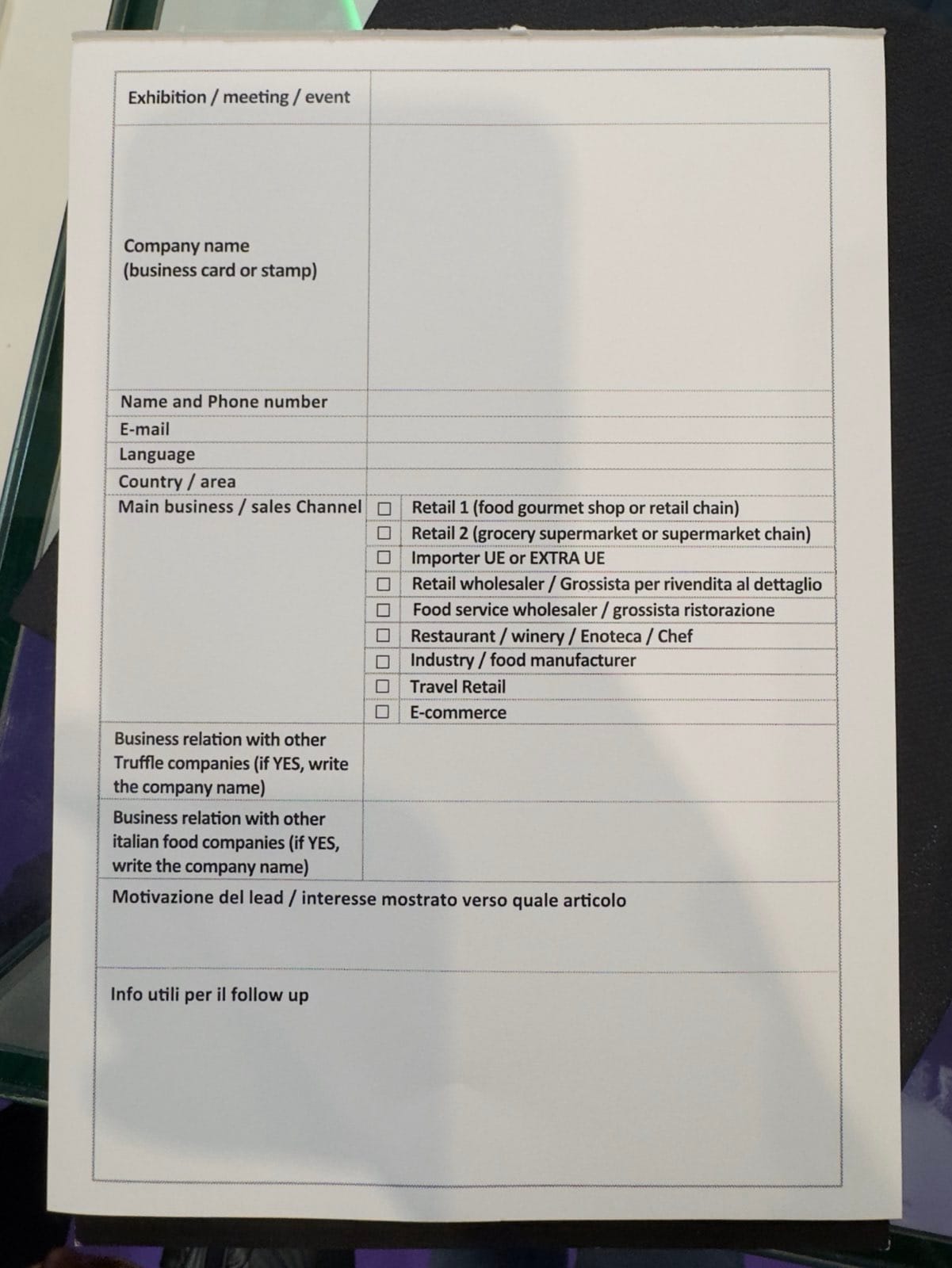

Walking the Gulfood floor, it was clear that much of the industry is not there yet. Deal-making still relied heavily on manual, fragile processes. Business cards were collected in stacks, stapled to notebooks, annotated with shorthand comments and follow-up questions. Conversations were rich, but the way relationships were captured was remarkably analog.

At an event of this scale, interests are expressed quickly and informally: a supplier asking about volumes, a buyer probing compliance in a specific market, a distributor testing appetite for a new SKU. Yet most of this context never makes it into a system. It lives in personal notes, WhatsApp threads, or memory. The result is uneven follow-up, missed matches between buyers and suppliers, and deals that stall simply because the signal was never properly captured or routed.

This is where a well-designed CRM can structure relationships as they form, linking contacts to companies, interests to products, conversations to opportunities, and then feeds that intelligence into execution layers like Salesflo or Bowimi, and into product and compliance systems like Centric. Done well, those that attend the trade show can turn it from a flurry of conversations into a mapped pipeline of intent.

What Gulfood revealed is not a lack of sophistication in the food industry. While the execution layers are advancing quickly, also AI… But many organisations still need to get the fundamentals right. Without strong operational systems (ERP, CRM, WMS, TMS, DW) the promise of execution-led innovation remains just that: a promise.

Before AI, before automation, CRM is the system that respects the value of relationships and ensures that interest, trust, and momentum don’t dissipate. In the food businesses, the most impactful place to start is not with advanced analytics or AI pilots, but with getting the basics right: capturing relationships early, structuring intent consistently, and building a CRM that reflects how trade actually happens.